When you glance at your smartwatch at the end of a shift, the numbers often look fine. Heart rate steady, steps hit, oxygen levels normal. The real story is in the trends. A resting heart rate that inches upward week after week or a sleep score that keeps sliding may not set off alarms right away, but they are signals worth paying attention to before they turn into larger problems.

The same is true for the One Big Beautiful Bill Act (OBBBA) and recent Medicaid changes. They’re not collapsing EMS budgets overnight, despite what the loudest headlines claim. Coverage and reimbursement patterns are shifting gradually, and the effects vary from state to state and community to community. For EMS leaders, the challenge is to keep an eye on those signals, track how they develop, and prepare for the direction they point to over time.

History Shows the Pace

Digitech believes that looking at historic changes in healthcare coverage offers a clearer picture of what OBBBA’s impact might actually look like. Two examples stand out: the Medicaid unwinding process after COVID when states resumed normal eligibility requirements, and the enhanced subsidies that made Affordable Care Act (ACA) Marketplace plans more affordable. These show that changes are likely to occur relatively slowly, can shift direction over time, and impact states and communities in very different ways.

Medicaid Unwinding: A Patchy Drop in Coverage

Medicaid “unwinding” is the term for states returning to normal checks after the COVID-era continuous enrollment provision that let people stay enrolled without reapplying. That provision ended in March 2024, and ten months after that, only about half of those originally covered had been re-enrolled. Nationally, this resulted in a 10% drop in Medicaid enrollees.[1] The decrease, however, was far from even: Texas saw enrollment fall by about 20%, while California’s net enrollment decline was just 5.8%.

There was a correlation between the size of the drop and whether a state had expanded Medicaid coverage under the Affordable Care Act or not. Non-expanded states tended to be more aggressive in pursuing Medicaid unwinding, but even within those states, the approach varied. According to another Kaiser Family Foundation analysis, a year after unwinding began, 17% of people in non-expansion states were uninsured, compared to just 8% in expansion states.[2] In other words, where you live plays a major role in whether losing Medicaid means getting other coverage or going without coverage entirely.

By 2025, the Gaps Are Clear

By mid-2025, the trend lines are hard to miss. In just two years, Texas lost 29% of its Medicaid-covered population from March 2023 to April 2025. During that same period, California saw only a 7% decrease. For EMS providers, that gap represents how many of your patients show up with coverage and how much of your run volume gets reimbursed.[3]

Major Unknowns

That statewide drop in Medicaid coverage shows up clearly in local EMS billing data. Here’s a snapshot from Digitech’s client agencies[4]:

Texas – Medicaid

| Municipality Type | Effective Change |

| Large metro city | -12% |

| Mid-size city | -22% |

| Mid-size city | -27% |

| Mid-size city | -26% |

| Rapid-growth suburb | -19% |

Whether it’s a large metro system or a fast-growing suburb, agencies in Texas saw noticeable declines in Medicaid-covered patients between 2023 and 2024.

California – Medicaid

| Municipality Type | Effective Change |

| Large city | -4% |

| Large county | -2% |

| Medium county | 8% |

| Mid-size city | 5% |

| Rapid-growth suburb | -7% |

| Mid-sized city | 1% |

| Small town | -13% |

In California, the results were more mixed based on locality. For this set of agencies, the combined total Medicaid transports were down 4.5%.

A small percentage of people who lost Medicaid nationwide did manage to get other coverage. About 4% obtained employer-sponsored insurance, 2% through the ACA Marketplace, and another 2% through Medicare[2].

Even so, Medicaid unwinding meant fewer patients with Medicaid in nearly every state, which put downward pressure on reimbursements for EMS agencies (and all healthcare providers). As the Texas-California comparison shows, the size of that drop, and the associated budget impact that follows, depends heavily on where your agency operates.

Enhanced Subsidies: Another Force in Play

At the same time Medicaid enrollment was dropping, another federal policy had a counterbalancing impact on the Medicaid reductions. The American Rescue Plan Act of 2021 (ARPA), later extended through the end of 2025 by the Inflation Reduction Act of 2022 (IRA), enhanced subsidies for ACA Marketplace plans, making them more affordable for millions of Americans.

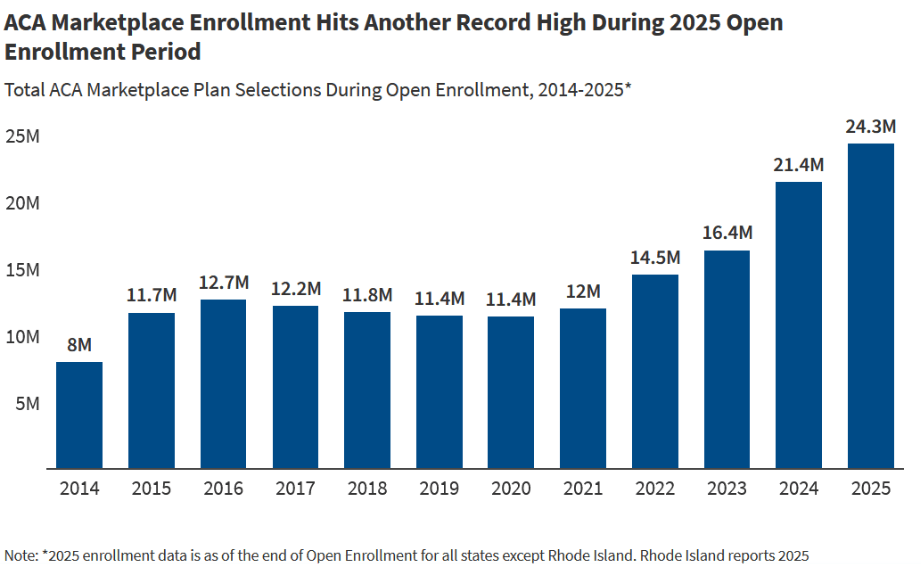

The result was a substantial increase in Marketplace enrollments. Per Kaiser Family Foundation, enrollment doubled nationally from 2021 to 2025.[5] That growth helped offset some of the Medicaid losses, though the impact varied by state.

Just as we saw with Medicaid unwinding, the ACA enrollment surge did not hit every state the same way. From 2020 to 2025, Texas saw a huge jump with a 255% increase in Marketplace plan enrollment. California’s enrollment growth was smaller at 29%.[4]

Digitech’s client data again mostly validates this trend. In a sampling of Texas agencies, we saw strong growth rates in the commercially insured population as more residents moved onto ACA plans thanks to the expanded subsidies.

Texas – Commercial Insurance

| Municipality Type | Effective Change |

| Large metro city | 14% |

| Mid-size city | 16% |

| Mid-size city | 16% |

| Mid-size city | 19% |

| Rapid-growth suburb | 0% |

California did not see the same uplift in insurance coverage per Digitech’s agency-level data.

California – Commercial Insurance

| Municipality Type | Effective Change |

| Large city | 5% |

| Large county | -2% |

| Medium county | -5% |

| Mid-size city | -6% |

| Rapid-growth suburb | -9% |

| Mid-sized city | -8% |

| Small town | -1% |

Why was this the case? California had been aggressive in enrolling people within their state exchange, Covered California, prior to COVID and individuals who do not have healthcare coverage throughout the year are subject to a penalty on their tax return. The Texas gains for EMS agencies were strong, but not as much as the overall healthcare numbers. Digitech believes this is primarily due to the fact that EMS services skew toward the elderly and underinsured. That means macro changes in Commercial insurance coverage have a muted impact on EMS providers.

Enhanced subsidies are a good example of a federal policy change that took years to roll out and gradually but steadily increased the number of people with coverage. Additionally, it highlights just how differently the same policy can play out from state to state and locality to locality.

What This Means for Your Agency

Federal and state policy changes have an impact on the number of insured patients in your community, but the effects usually play out over years, not months. Multiple initiatives, sometimes moving in opposite directions, make it difficult to isolate immediate impacts.

OBBBA’s tighter Medicaid rules will push some off the program, mostly to the uninsured category. Because those changes are phased in over several years, the impact will be gradual and different in every state and every municipality. Meanwhile, the ACA subsidies are currently slated to lapse unless Congress takes action. If that occurs, enrollment in the marketplace exchanges is likely to drift downward, with more patients falling into the uninsured bucket.

It will take a decade for Medicaid cuts under OBBBA to fully take effect, with the steepest reductions coming in years 5-10. Immediately after the bill passed, some of the lawmakers who supported it were already exploring ways to soften the impact of those cuts. And over the next nine years, political shifts are inevitable, making it nearly impossible to predict the exact long-term outcome.

For now, Digitech expects EMS agencies to experience a gradual decline in reimbursements over the next few years related to recent federal legislative action/inaction. It won’t feel like a sudden budget crisis, but the trend is there and worth monitoring. The key is to treat these shifts the way you’d treat a patient’s vitals or your own smartwatch readout. Day to day, everything may look steady, yet the numbers may drift in ways that matter down the road. If you track them early and plan for the direction they’re heading, you’ll stay in control. If you assume stability, you risk being caught off guard by shifts that could affect staffing, equipment, or service levels.

[1] Source: Kaiser Family Foundation. Three Questions About Medicaid Unwinding: What We Know and What to Expect by Robin Rudowitz, Jennifer Tolbert, and Larry Levitt. February 28, 2024

[2] Source: A state-by-state comparison can be found in this analysis: Kaiser Family Foundation. KFF Survey of Medicaid Unwinding by Lunna Lopes, Grace Sparks, Marley Presiado, Jennifer Tolbert, Robin Rudowitz, Amaya Diana, and Ashley Kirzinger. April 12, 2024

[3] Source: Kaiser Family Foundation. Medicaid Enrollment and Unwinding Tracker. July 28, 2025

[4] Data for both States represents more than 100,000 transports for agencies where comparable Digitech data existed for both 2023 and 2024. The Effective Change normalizes for changes in transport volume occurring at each agency.

[5] Source: Kaiser Family Foundation. Enrollment Growth in the ACA Marketplaces by Jared Ortaliza, Justin Lo, and Cynthia Cox. Apr 02, 2025

Inside FRI 2025: Innovation, Trends, and the Road Ahead

Inside FRI 2025: Innovation, Trends, and the Road Ahead