Check out our webinar on this topic: Best Practices for EMS Providers Now That Mandatory Cost Reporting is Underway

Mandatory CMS cost reporting was announced in earnest several years ago, only to be interrupted and delayed (like many things in our lives) by the COVID Public Health Emergency. Now, ground ambulance providers are focused on reporting under the Medicare Ground Ambulance Data Collection System (GADCS), with approximately half of all EMS agencies well into or even having newly completed their mandatory data capture. The other half of EMS agencies are at the beginning stages of collecting the required data. The process of data submission to CMS has just begun, depending on the reporting period for each agency.

Now is a good time to take a look at some of the context around mandatory CMS cost reporting and examine the impacts on Medicare reimbursements in the medium-term as a result of these efforts.

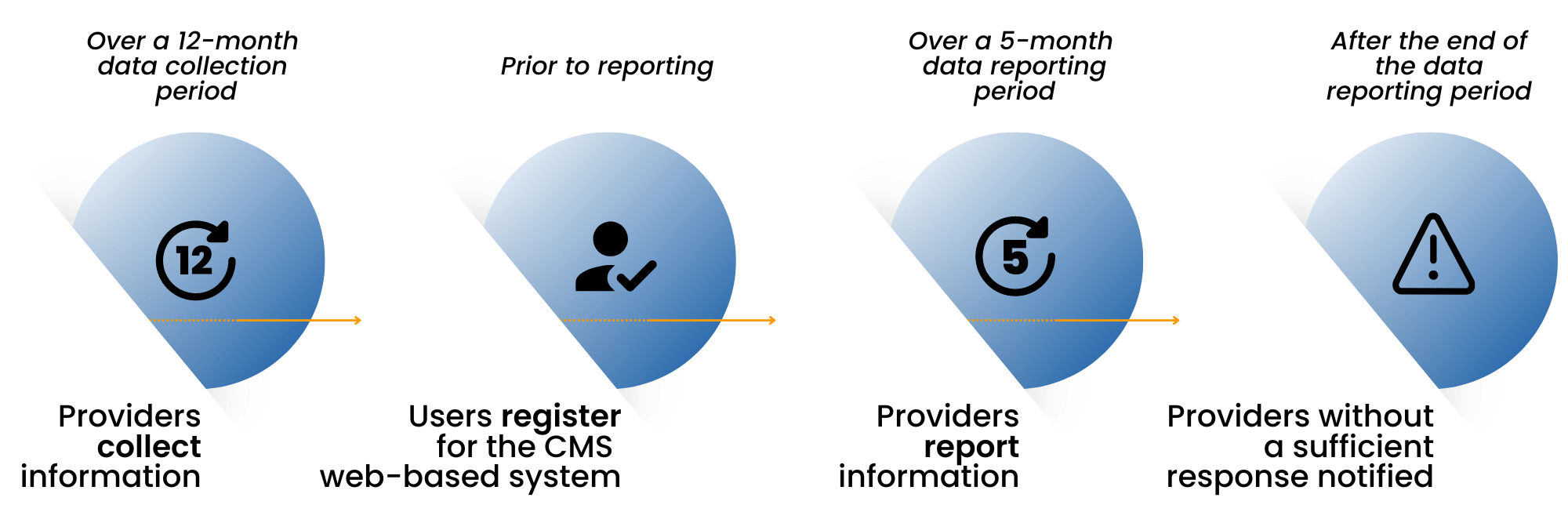

GADCS Key Milestones for EMS Providers

First, let’s review the history of ambulance reimbursements and how the structure for ambulance reimbursements differs from the reimbursement allowables that Medicare sets for other healthcare services.

In 2002, Medicare implemented a phased-in national fee schedule for ambulance services. The goal was to address the high variability in the amounts being reimbursed depending on whether an EMS provider was hospital-based or independent. In 2005, the Government Accountability Office (GAO) conducted a cost study. Interestingly, of the responses received in the cost study, 1/3 were omitted because the responding services were Fire-based and did not have a clean carveout of only ambulance costs versus other costs. The GAO report estimated that in 2010, excluding most Fire based agencies, 39-56% of providers would receive average Medicare reimbursement payments that would exceed their costs – which means, conversely, that half or more of the providers would not be able to cover their costs with Medicare’s reimbursements (Ambulance Providers: Costs and Expected Medicare Margins Vary Greatly, 2007). Additionally, the GAO report identified super rural providers as being at the highest risk of having Medicare payments well below their costs.

In an attempt to address the perceived shortfall in Medicare reimbursement, Congress included temporary Medicare ambulance bonus payments in the Medicare Modernization Act that paid an additional 2% (urban), 3% (rural), and 22.6% (super rural), starting in 2004. Those temporary bonus payments have been extended, with much debate, every few years since then.

Elsewhere in healthcare services – hospitals, physicians, clinics, labs – Medicare payments are established via an annual collection of cost data from all providers. CMS uses the collected data to update the allowable amount continually to cover costs for the provider, plus a reasonable margin. Ambulance services have been the exception, and the industry has been vocal about the existing allowables not being sufficient to cover the costs of providing the service. Outside of the 2005 GAO study, which excluded a large number of fire-based municipal ambulance providers, there is little factual data that ties current reimbursements to current ambulance rates. The amounts set in 2002 are adjusted by an annual inflation factor. The “temporary” Medicare add-on bonus payments are a modest recognition that the current Medicare rates are insufficient.

As you likely have inferred, the ambulance cost reporting initiative by CMS is intended to put ambulance providers on par with other healthcare service providers in terms of assessing costs and delivering fair reimbursement. EMS providers have received a concession, at least initially, by not being required to submit cost data annually, but rather every four years.

The collected and reported data is going to the Medicare Payment Advisory Commission (MedPAC); MedPAC will then be required to submit a report to Congress on the adequacy of Medicare payment rates for ground ambulance services and geographic variations in the cost of furnishing such services. The timing of that report is not specified. The idea is that, at some point in the future, the data would be used for resetting the amounts Medicare will pay to ground ambulance providers.

There has been speculation by some providers that the Medicare allowable amounts will go up significantly as a result of the cost reporting submissions, while others believe the amounts could drop. This difference in perspective likely depends on what type of agency you are. Fully integrated providers under municipal structures typically have costs substantially higher than the current allowables, but private ambulance services that provide a large percentage of 911 services nationwide typically have a much lower cost structure. Also, agencies running all-ALS services have a higher cost structure than those that have a mix of ALS and BLS vehicles in their system.

No matter what, over the next several years, we expect to see changes to Medicare reimbursements in ground ambulance as a result of the cost reporting efforts. Generally the sentiment is that, at minimum, the cost of providing 24/7 911 services has increased faster than the current inflation factor accounts for. Time will tell, but there is a reasonable chance that reimbursements will be enhanced to better align with today’s costs of providing this critical service.

Digitech hopes that you find this context about the substantial Medicare GADCS cost reporting effort useful to understand the system more deeply or to explain the reasons to your key stakeholders. Please reach out to CMSDataCollection@digitechcomputer.com if you would like more information about Digitech’s data collection software, which assists agencies in organizing the required data elements, or if you would like assistance in data collection via our cost reporting consulting services.

—

Check out our webinar on this topic: Best Practices for EMS Providers Now That Mandatory Cost Reporting is Underway